Is cryptocurrency for African-Americans? Are we in on the game or are we just too cautious with our money to get in right now? Can cryptocurrencies like Bitcoin help the Black economy? Are we ready or even willing to get in the digital cash game? I said it before and I’ll say it again; Black people don’t play when it comes to money!

Is cryptocurrency for African-Americans? Are we in on the game or are we just too cautious with our money to get in right now? Can cryptocurrencies like Bitcoin help the Black economy? Are we ready or even willing to get in the digital cash game? I said it before and I’ll say it again; Black people don’t play when it comes to money!

From Black celebrity endorsements to black people actually mining cryptocurrencies the game is starting to open up and awareness is growing. But are we truly on board?

Black celebrities are pushing cryptocurrencies and initial coin offerings or ICO. An ICO is an unregulated way to raise money for new cryptocurrencies. ICOs are used by startups to get around the rigid rules and laws associated with the regular capital-raising process. In other words they can raise money without any rules or laws to obey. This makes ICOs an extremely risky investment.

Risky investments do not appeal to African-Americans. “African-Americans are risk-averse,” says Deborah Owens, formerly of Fidelity Investments. Owens calls herself “Americans Wealth Coach.” Owens told Forbes.com that, “So, one of the major reasons they have less in retirement savings is they are ultra-conservative, particularly African-Americans who work in the public sector and nonprofit organizations.”

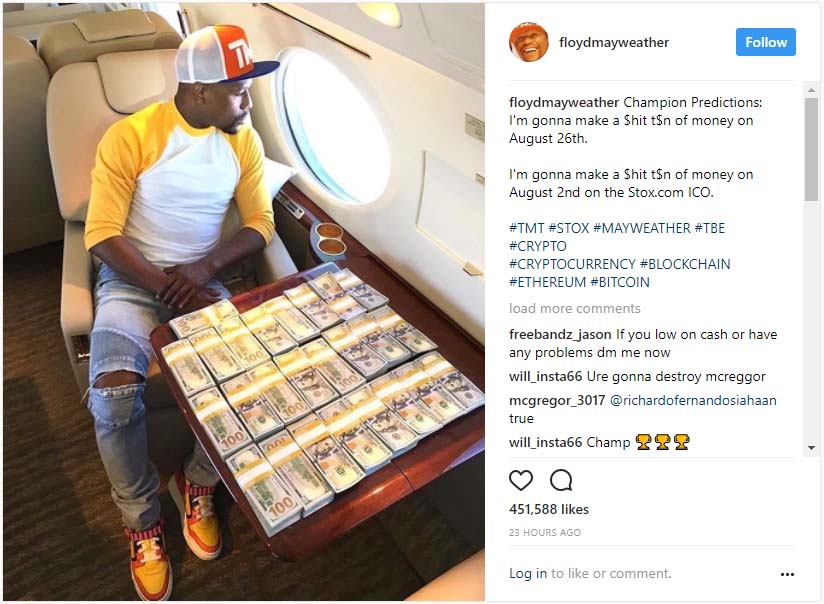

Ultra popular DJ Khaled, alongside boxer Floyd “Money” Mayweather are pumping up Centra Tech. Chief operating officer for Centra Tech, Raymond Trapani, told Fortune.com that Khaled and Mayweather are working as “official brand ambassador and managing partner” of the company. But the government has issued warnings about their investment advice in digital currencies.

Mayweather, in addition to Centra Tech, he is also associated with ICOs from Stox.com and Hubii Networks. Critics say both companies are risky blockchain technologies and neither has produced a product, service or profit.

Mayweather, in addition to Centra Tech, he is also associated with ICOs from Stox.com and Hubii Networks. Critics say both companies are risky blockchain technologies and neither has produced a product, service or profit.

Other Black celebrities involved in cryptocurrency include rapper Snoop Dogg, Nas, former Spice Girl Mel B, actor Donald Glover, Seattle Seahawks cornerback Richard Sherman, former NFL wide receiver Chad Ochocinco, actor/comedian Jamie Foxx, and WuTang Clan’s GhostFace Killah.

Needless to say these are fairly wealthy artists and athletes who can afford to play in the cryptocurrency casino and help ICOs raise billions of dollars. But is their involvement even legal?

The U.S. Securities and Exchange Commission (SEC) is looking real hard at these celebrity endorsements. The SEC issued a statement to “celebrities and others” who use social media networks to encourage the public to purchase stocks and other investments.

The statement advises celebrities that, “These endorsements may be unlawful if they do not disclose the nature, source, and amount of any compensation paid, directly or indirectly, by the company in exchange for the endorsement.” Put simply these celebrities need to come clean and let people know they are partners or investors in the company they are pushing.

But are Black people buying cryptocurrencies? Edwardo Jackson of Blacks in Bitcoin believes its still early and that African-Americans need to get in the game and get in the game now. Jackson told TheAtlantic.com, “Can you imagine what it would have been like to own a piece of email technology in 1994? That’s what Bitcoin is like right now, and it’s only getting bigger.”

Along with Black celebrities Jackson could be opening the door for minorities to get into cryptocurrencies. Research in 2014 showed that black people and minorities in general were not aware of the cryptocurrency phenomenon. But now the African-American community is becoming more aware of digital currency and the wealth it can produce. Black people interested in Bitcoin and possibly investing in digital currency are beginning to form groups to study this phenomenon. One MeetUp group in Atlanta has over 180 members and the interest appears to be growing. Sources of information for black people are also growing as evidenced by Jackson’s blog “Blacks in Bitcoin.”

Can digital currency help the African-American community? An interesting fact about Black people in the digital age is our love of mobile technology. Black people have become early and enthusiastic adapters of mobile technology. We are most likely to shop and access the Internet using smartphones than white people. So the idea of using a digital currency is not out of the realm. Another interesting fact is that Black communities, low income neighborhoods, are severely under-banked.

Chief market strategist for ConvergEx Group, Nicholas Colas believes digital currency like Bitcoin can make a difference. Colas sees the currency filling the hole where banks are not in these communities. Colas cited a 2013 Senate committee letter from then-Federal Reserve chairman Ben Bernanke. Bernanke did not endorse digital currency but agreed low-cost transactions could benefit low income, under-banked communities. Providers of pre-paid cards and payday loans often thrive in low income communities. Colas added, “That’s where the promise is for the African American community, because in a finished form, it allows for a cheaper money-transfer system than anything that the current financial system can provide.”

African-Americans are beginning to take notice of digital currency and are venturing in with their own brand of digital currency. A Black owned digital currency company, BitMari, has emerged. Founded in 2015, BitMari is a Pan-African blockchain company seeking to secure a piece of the action in the billions of dollars sent to Africa each year. BitMari is facilitating the transfer or remittance of money using the Bitcoin technology into Africa.

African-Americans are beginning to take notice of digital currency and are venturing in with their own brand of digital currency. A Black owned digital currency company, BitMari, has emerged. Founded in 2015, BitMari is a Pan-African blockchain company seeking to secure a piece of the action in the billions of dollars sent to Africa each year. BitMari is facilitating the transfer or remittance of money using the Bitcoin technology into Africa.

$Guap Black Owned Digital Currency

Another Black owned digital currency is $Guap launched by tech visionary Tavonia Evans. The ICO for $Guap is aimed at recycling wealth within the Black community. $Guap is intended to leverage the one trillion dollars in Black spending power. $Guap will jump on the cryptocurrency wave by rewarding African-American consumers for supporting businesses that support them.

Now you know.