Tax Season 2016 – Tax Prep Apps of the Week

The Internet rapidly automated so many things including filing your taxes. Because of technology and software advances as many as 80 percent of Americans can and do prepare their own taxes using various software and web services.

Many African-Americans access the web using smartphones. Because of this we need to examine some very good apps that can help you if decide to do your own taxes using your smartphone. These apps are designed to allow you to record and prepare financial records and even file taxes directly from your smartphone. These are the Apps of the Week.

IRS2Go – This is the official app of the Internal Revenue Service. Although you cannot actually file your taxes using this app you can check the status of your tax refund, make tax payments, and get updates from the IRS. IRS2Go also offers important numbers and times to call and ask questions. You can also sign up for tax hints through the app. For those of you who filed e-taxes you can check on their status with the app within 72 hours.

IRS2Go – This is the official app of the Internal Revenue Service. Although you cannot actually file your taxes using this app you can check the status of your tax refund, make tax payments, and get updates from the IRS. IRS2Go also offers important numbers and times to call and ask questions. You can also sign up for tax hints through the app. For those of you who filed e-taxes you can check on their status with the app within 72 hours.

IRS2Go is free and available for Apple and Android.

My Block – Unlike IRS2Go the H&R My Block app is a bit more rich in features. My Block, one of two apps offered by the tax prep giant, allows the user to check their refund status. My Block also offers a robust help section that defines terms and answer basic tax questions. It also offers a checklist that helps the user create a tax filing to-do list along with tools that allow you to estimate the size of your refund. If you have additional questions My Block allows you to set up an appointment at a local H&R Block office. You can also use My Block to upload documents so your tax pro will have them available during your appointment.

My Block – Unlike IRS2Go the H&R My Block app is a bit more rich in features. My Block, one of two apps offered by the tax prep giant, allows the user to check their refund status. My Block also offers a robust help section that defines terms and answer basic tax questions. It also offers a checklist that helps the user create a tax filing to-do list along with tools that allow you to estimate the size of your refund. If you have additional questions My Block allows you to set up an appointment at a local H&R Block office. You can also use My Block to upload documents so your tax pro will have them available during your appointment.

My Block is free and available for Apple and Android.

Tax Pr eparation – H&R Block’s Tax Preparation is different from its sister app because it actually allows the user to prepare and file tax returns. Tax Preparation does a neat trick by collecting and importing information directly from a photo of your W-2. The user can select from various versions from free, basic, deluxe to premium editions. The app shows the user what causes their refund to fluctuate, offers cross-platform syncing and status updates on your return. The app also offers advice and free, in-person audit support.

eparation – H&R Block’s Tax Preparation is different from its sister app because it actually allows the user to prepare and file tax returns. Tax Preparation does a neat trick by collecting and importing information directly from a photo of your W-2. The user can select from various versions from free, basic, deluxe to premium editions. The app shows the user what causes their refund to fluctuate, offers cross-platform syncing and status updates on your return. The app also offers advice and free, in-person audit support.

Tax Preparation is free ad available for Apple and Android.

Expensify – Expensify wasn’t exactly made for preparing taxes. But if you own a business or are self-employed this app can help you get the most from your deductions. Using the app allows the self employed business person or any business owner to capture receipts, track billing hours and travel miles. Expensify allows the user to record any expenses or operating costs. It also automatically imports credit card transactions and scan receipts for expense reports that can later be converted to IRS-approved e-Receipts minimizing paper usage and hopefully any tax-related discrepancies.

Expensify – Expensify wasn’t exactly made for preparing taxes. But if you own a business or are self-employed this app can help you get the most from your deductions. Using the app allows the self employed business person or any business owner to capture receipts, track billing hours and travel miles. Expensify allows the user to record any expenses or operating costs. It also automatically imports credit card transactions and scan receipts for expense reports that can later be converted to IRS-approved e-Receipts minimizing paper usage and hopefully any tax-related discrepancies.

Expensify is free and available for Apple and Android.

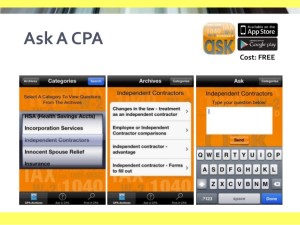

Ask A CPA – Ask A CPA is an app with a host of basic tips encompassing the latest changes in tax law. These tips cover a variety of different categories, from alimony and dividends to adoption expenses and charitable deductions. Ask A CPA also gives the user the opportunity to ask specific questions it hasn’t already covered within the app’s archives. However there have been complaints about the text space available for questions. The coolest feature is that local CPAs in your area answer these questions. Ask A CPA is a powerful resource for owners of small businesses who need answers to common tax questions but also for individual taxpayers.

Ask A CPA – Ask A CPA is an app with a host of basic tips encompassing the latest changes in tax law. These tips cover a variety of different categories, from alimony and dividends to adoption expenses and charitable deductions. Ask A CPA also gives the user the opportunity to ask specific questions it hasn’t already covered within the app’s archives. However there have been complaints about the text space available for questions. The coolest feature is that local CPAs in your area answer these questions. Ask A CPA is a powerful resource for owners of small businesses who need answers to common tax questions but also for individual taxpayers.

Ask A CPA is free and available for Apple and Android.

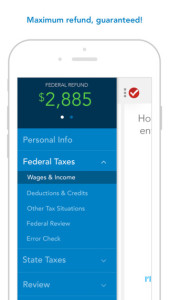

TurboTax Preparation – TurboTax Preparation works very similar to its online counterpart. The app offers a wealth of tax-related information and tools for preparing and e-filing your taxes. Like H&R Block’s Tax Preparation app the TurboTax app can also pull information from a photo of your W-2. It provides step-by-step instructions while seeking out as many as 350 tax deductions and credits intended to maximize your refund. The app double checks your return and the information you provided as you go. Once loaded on your different devices the app syncs so you can switch between your iPhone, iPad or computer.

TurboTax Preparation – TurboTax Preparation works very similar to its online counterpart. The app offers a wealth of tax-related information and tools for preparing and e-filing your taxes. Like H&R Block’s Tax Preparation app the TurboTax app can also pull information from a photo of your W-2. It provides step-by-step instructions while seeking out as many as 350 tax deductions and credits intended to maximize your refund. The app double checks your return and the information you provided as you go. Once loaded on your different devices the app syncs so you can switch between your iPhone, iPad or computer.

Turbo Tax Preparation is free and available for Apple and Android.

TaxACT Express – TaxAct Express is another full service app for filing taxes. It can help with most common tax situations and, like other apps, automatically imports information from a photo of your W-2. The app will track the status of your IRS refund and notify you when it’s been processed. The app also offer free e-filing of state and federal taxes for free.

TaxACT Express – TaxAct Express is another full service app for filing taxes. It can help with most common tax situations and, like other apps, automatically imports information from a photo of your W-2. The app will track the status of your IRS refund and notify you when it’s been processed. The app also offer free e-filing of state and federal taxes for free.

Tax ACT Express is free and available for Apple and Android

BNA Quick Tax Reference – BNA Quick Tax Reference provides some valuable reference material but is not exactly easy to use but then again it is meant for the more financially savvy user. The user can find tables showing mileage rates, corporate tax rate schedules, individual tax rate schedules, standard deductions, retirement plan limits, and more. If you looking to file back taxes the tables can take you back to 2012.

BNA Quick Tax Reference – BNA Quick Tax Reference provides some valuable reference material but is not exactly easy to use but then again it is meant for the more financially savvy user. The user can find tables showing mileage rates, corporate tax rate schedules, individual tax rate schedules, standard deductions, retirement plan limits, and more. If you looking to file back taxes the tables can take you back to 2012.

BNA Quick Tax Reference is free and available for Apple and Android.

TaxCaster – This app is also offered by Intuit makers of the TurboTax products. TaxCaster is designed for filers with relatively simple taxes and a single job, much like the 1040EZ and 1040A tax forms and you don’t have to sign up to use it. The user simply enter their wages, marital status, earnings, and deductions. TaxCaster can quickly give you a good idea of what kind of refund you might receive. This fairly simple app won’t prepare your taxes, but it can give you a good idea what to expect when you do.

TaxCaster – This app is also offered by Intuit makers of the TurboTax products. TaxCaster is designed for filers with relatively simple taxes and a single job, much like the 1040EZ and 1040A tax forms and you don’t have to sign up to use it. The user simply enter their wages, marital status, earnings, and deductions. TaxCaster can quickly give you a good idea of what kind of refund you might receive. This fairly simple app won’t prepare your taxes, but it can give you a good idea what to expect when you do.

TaxCaster is free and available for Apple and Android.