Photo Courtesy: Chris Sharp

Lets face it, user names and passwords are easily compromised. Credit card data theft and data breaches are commonplace. Paying for anything by credit or debit card is simply a dangerous action and if something goes wrong it could change your life. So what is the alternative? It may be your smiling face that secures your next payment.

On Tuesday Amazon filed for a patent for an image based payment authentication system. Pay by selfie may be a future harbinger of online purchasing. Amazon’s patent uses image-authentication technology to identify the user. The technology demands the user perform a movement or motion to verify the user is alive and not a photo used to possibly fool the technology.

Last year, MasterCard introduced a similar system called MasterCard Identity Check. That system is scheduled to be introduced to the U.S. market sometime in the middle of this year. China-based online retailer Alibaba is also testing a facial recognition-enabled payment system.

Its no secret that selfies are extremely popular. What is also extremely popular is mobile computing among African-Americans. Blacks use their mobile devices to do banking, shopping and other business more than any other group. But these mobile devices are extremely vulnerable to attack and hacking. Throw in the free wifi or the infected app and you could experience financial ruin. Pay by selfie could be a major payment revolution putting an end to cards, user names and PINs.

But personal authentication is moving beyond user names and PINs with other new technology. MasterCard’s is researching other forms of biometric authentication including electrocardiogram or heartbeat recognition. The company’s conducted consumer trials with the Nymi Band, a heart rate tracker, in Canada and the Netherlands. The biggest advantage of heart rate tracking is that is constant verification by taking readings in the background.

ATMs are also about to see advancements in identification. Chase recently announced it will be introducing card-free ATMs that use smartphones for identification. Using their smartphones Chase customers will open an app enter a pin number that activates the ATM.

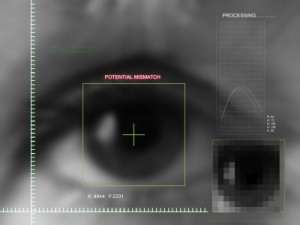

Another new ATM being tested by Citigroup also discards the card and PIN but instead allows a user to authorize ATM withdrawals using iris-scan biometric technology and a smartphone. The technology is being developed by Diebold. The machine is one of two new concepts presented at the Money 20/20 conference in Las Vegas.