Lets face it; technology is everywhere in our daily lives. So much so that we have gotten to the point where we use it without a thought. Hackers and thieves depend on a certain level of laziness to victimize people using card skimmers.

Lets face it; technology is everywhere in our daily lives. So much so that we have gotten to the point where we use it without a thought. Hackers and thieves depend on a certain level of laziness to victimize people using card skimmers.

Everyday millions of Africans-Americans pull out their debit or credit card and swipe it. We swipe it for gas, food, clothes, medicine, every conceivable purchase. But are we aware of how vulnerable your money, and even your financial life, is when you swipe your card?

One of the most prolific, and easiest, cyber crimes is the use of skimmers. A skimmer is a small device that is almost invisible to the naked eye. It is placed inside credit card readers. When you swipe your card through the reader the device records the information on your credit/debit card and transmits it to criminals. These skimmers can be found anywhere you use a credit card. The gas station, a convenience store or even an ATM. As I said already, spotting these little devices is very difficult. Sometimes the thieves will mount a skimmer over a card scanner. Sometimes they can gain access to the machine and mount the device inside. These cyber criminals are so good that they can even build skimmers with key pads that record your PIN and you would never know you were using it.

Newer credit and debit cards have what’s known as the EMV or chip and PIN cards. These are much more secure because they transmit transaction data encrypted. But those are not 100% secure either.

After they get your information they may decide to empty your bank account or max out your credit card on a shopping spree. Its called “card not present fraud.”

So how do you detect a card skimmer?

If you investigate the device you can sometimes spot a skimmer. Here are a few tips.

- Look for tampering. Check the device for any sign that it has been tampered with. Check top, bottom and both sides of an ATM. Check the card reader and the keyboard.

- Does it look right? Do you recognize it? If it is your bank ATM does it look different, such as a different color or material, graphics that aren’t quite correct or anything else that doesn’t look right. Be alert and paranoid about any machine.

- If you’re at the bank and there is more than one ATM compare them. Look for obvious differences between the two? They should be identical. If not alert the bank and police immediately.

- Check that keyboard. Is it too thick? Is it loose or just does not look like it fits right? There may be a PIN-snatching overlay. Don’t use it.

Fake ATM keypad

5. Push, pull, jiggle everything. ATM’s are pretty sturdy so it should feel solid. Card skimmers and fake key pads are installed quickly and if you pull on one it may come off in your hand.

6. Another good practice is to hide your hand when entering your PIN. Some hackers use tiny cameras mounted above the ATM to record your PIN. Use one hand to cover the other when entering your PIN.

A card skimmer can be anywhere. You need to be alert and look for any signs that something is wrong. Be aware of gas pumps that might have been tampered with. This is a favorite hacker target. Why? Because they have a high volume of traffic and are not closely monitored. A good crook can install a card skimmer in seconds and come back for it in a few minutes having collected data from several cards. He may do this at several gas stations in a single day.

But the criminal may not come back for the skimmer at all. In the past skimmers had memory chips that required criminals to come back and retrieve the device. No more. The newest skimmers can transmit the information via Bluetooth or text message to the criminals computer. They can install the skimmer and record for hours. And you don’t have to build these devices. You can easily buy these devices on the web where they are sold openly.

But you can fight back. Your smartphone can detect these Bluetooth skimmers. When you arrive at a gas pump or any location using a self-serve card machine whip out your smartphone and go to settings. Turn on the Bluetooth and have it search for sources. If a you see a string of suspicious numbers come up do not swipe your card in that pump or ATM. Report it to the police and store management immediately.

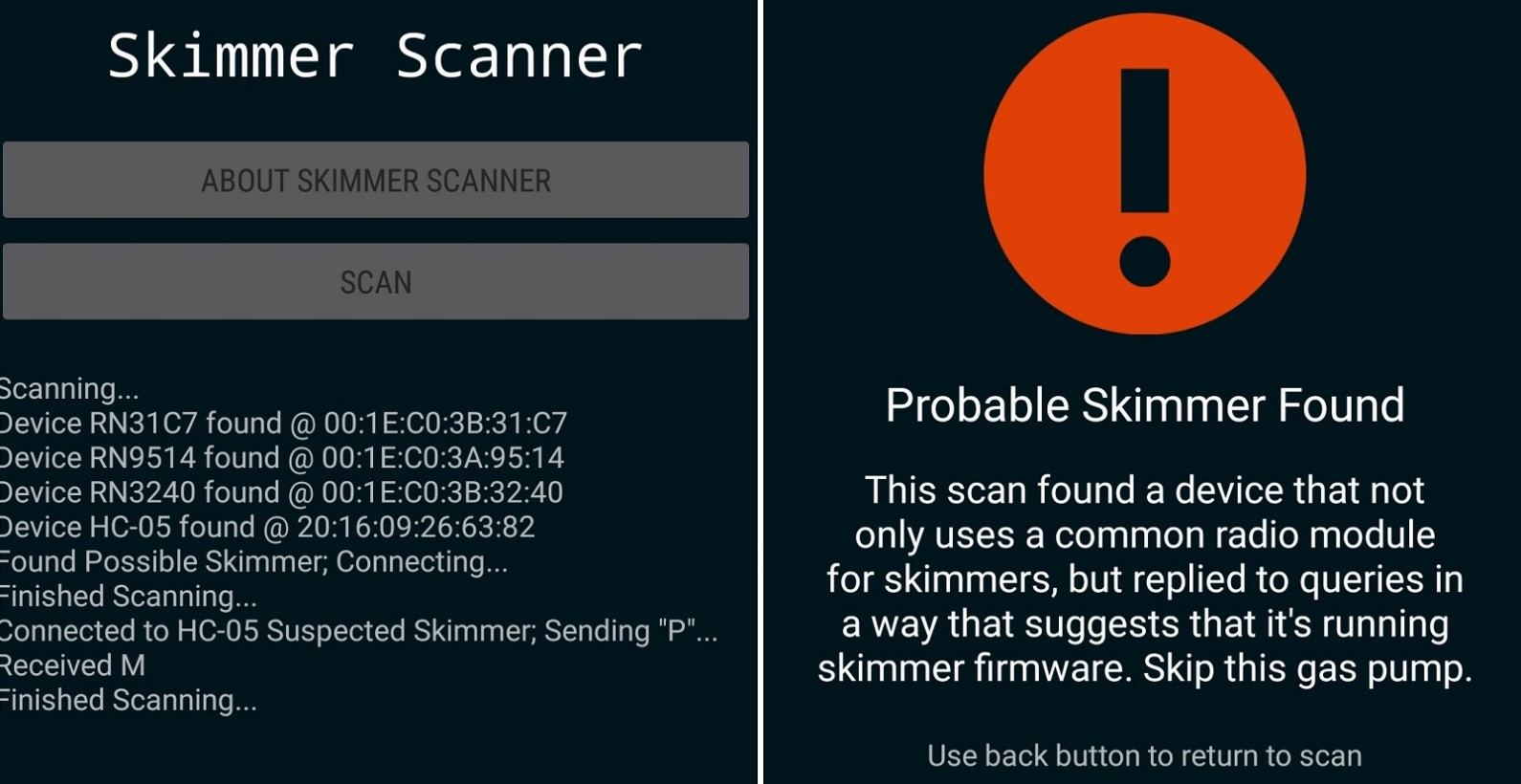

There are also apps that can detect skimmers. Skimmer Scanner is currently available for Android phones and it can detect the presence of a skimmer on a card swipe machine. The Skimmer Scanner app checks for nearby Bluetooth transmissions and alerts you when one is detected.

There are also apps that can detect skimmers. Skimmer Scanner is currently available for Android phones and it can detect the presence of a skimmer on a card swipe machine. The Skimmer Scanner app checks for nearby Bluetooth transmissions and alerts you when one is detected.

Now you know.

Valuable information! Looking forward to seeing your notes posted. The information you have posted is very useful. Keep going on, good stuff. Thank you for this valuable information